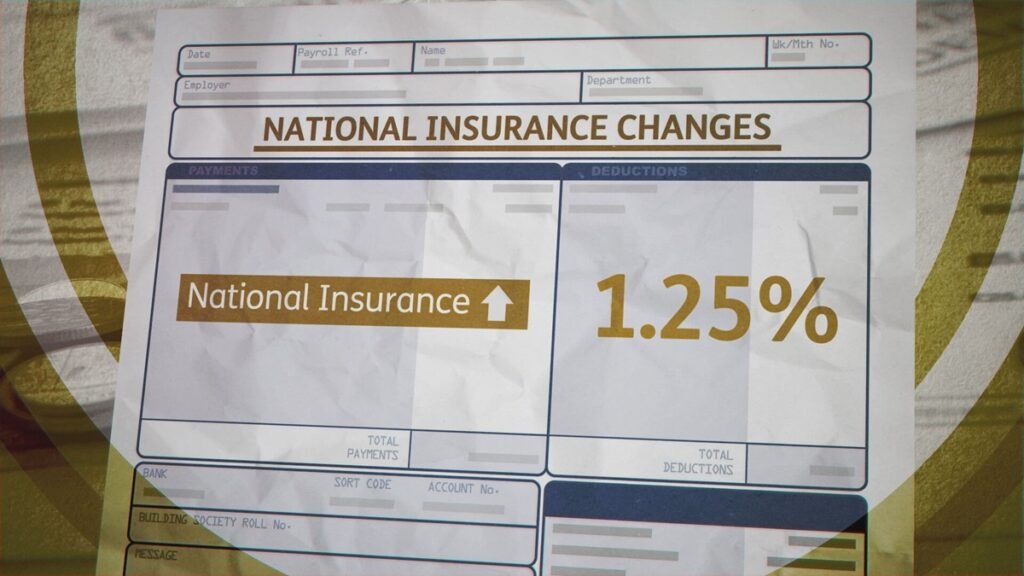

In 2024, significant changes to National Insurance (NI) rates are expected to take place, affecting both employees and the self-employed. The National Insurance Contributions (Reduction in Rates) Act 2023 made substantial adjustments to employee and self-employed NIC rates for the 2023–2024 tax year.

National Insurance (NI) is a crucial component of the UK’s tax system, contributing to state benefits and the NHS. It is a tax on earnings and self-employed profits, paid by employers, employees, and the self-employed.

Contents

What is National Insurance?

National Insurance is a tax paid by workers and the self-employed in the UK. It helps fund state benefits, including the state pension, and the National Health Service (NHS). National Insurance contributions are compulsory for most workers between the ages of 16 and state pension age.

National Insurance Changes 2024 (New NI)

Starting January 6, 2024, there will be a two percentage point reduction in the primary Employee National Insurance (NI) rate. This means that the Class 1 National Insurance Contributions (NICs) will be reduced from 12% to 10% for employees in the default NI category.

This change is expected to save workers with an average income of £35,400 annually around £450. The lower earnings limit, at which workers start receiving National Insurance credits, has been set at £6,396.

From April 2024, Class 4 NI for self-employed individuals will be reduced from 9% to 8%. Additionally, from April 2024, Class 2 NI for self-employed individuals will be abolished. Self-employed individuals earning more than £12,570 will no longer be required to pay Class 2 NICs but will still be eligible for contributory benefits.

The changes will affect those earning between £12,570 and £50,270. This means that millions of employees will benefit from these changes. The maximum gross savings per year could be £754, with an average annual salary of £35,400 resulting in an average benefit of £450 after taxes.

How They Affect You in 2024

These changes will have different impacts depending on your NI category and income level. The changes will benefit millions of employees, but the exact impact will vary based on individual circumstances.

It is recommended to inform employees of these changes through pay stubs from January or February. This can help reduce inquiries and ensure employees are aware of the adjustments.

If your payroll system or provider has not updated the rate promptly, there will be opportunities to rectify any overpayments of NI in the coming months.

Final Discussion

Many independent contractors and businesses are grateful for the government assistance provided through the National Insurance reductions in 2024. These changes will help alleviate some of the challenges posed by rising interest rates and inflation. However, the specific impact of these changes will vary for each employer and self-employed individual.